Cleveland Private Trust Company provides services as a fiduciary designed to assist investors in all aspects of decision-making related to the investment of their assets.

- Investment objectives development

- Investment strategy review

- Asset and liability modeling

- Analysis of unique investment opportunities

- Investment manager due diligence and monitoring

- Performance reporting, evaluation and monitoring

- Education on investment and governance related topics

We invest with a long term perspective and create customized investment strategies that will enable clients to meet their objectives. Our investment programs are specific to client needs, and are:

- Consistent with investment time horizons

- Reflective of risk tolerances

- Designed to meet liquidity needs

- Monitored on an ongoing basis

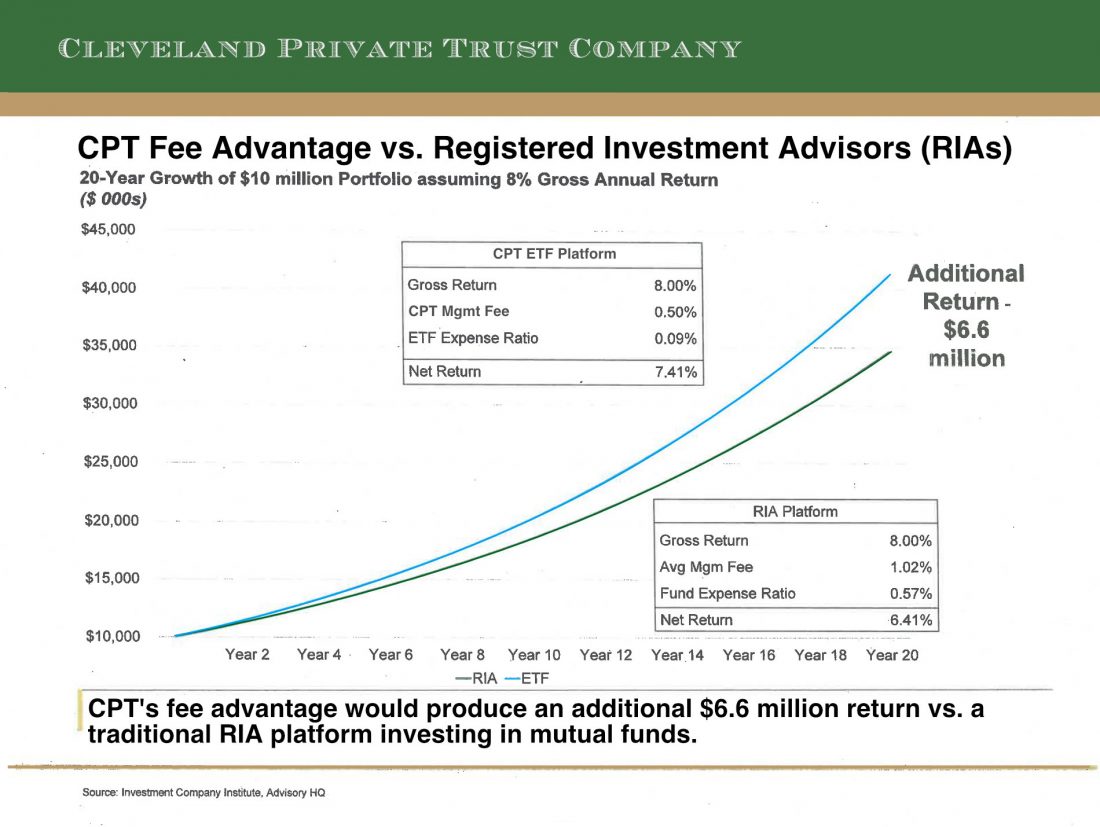

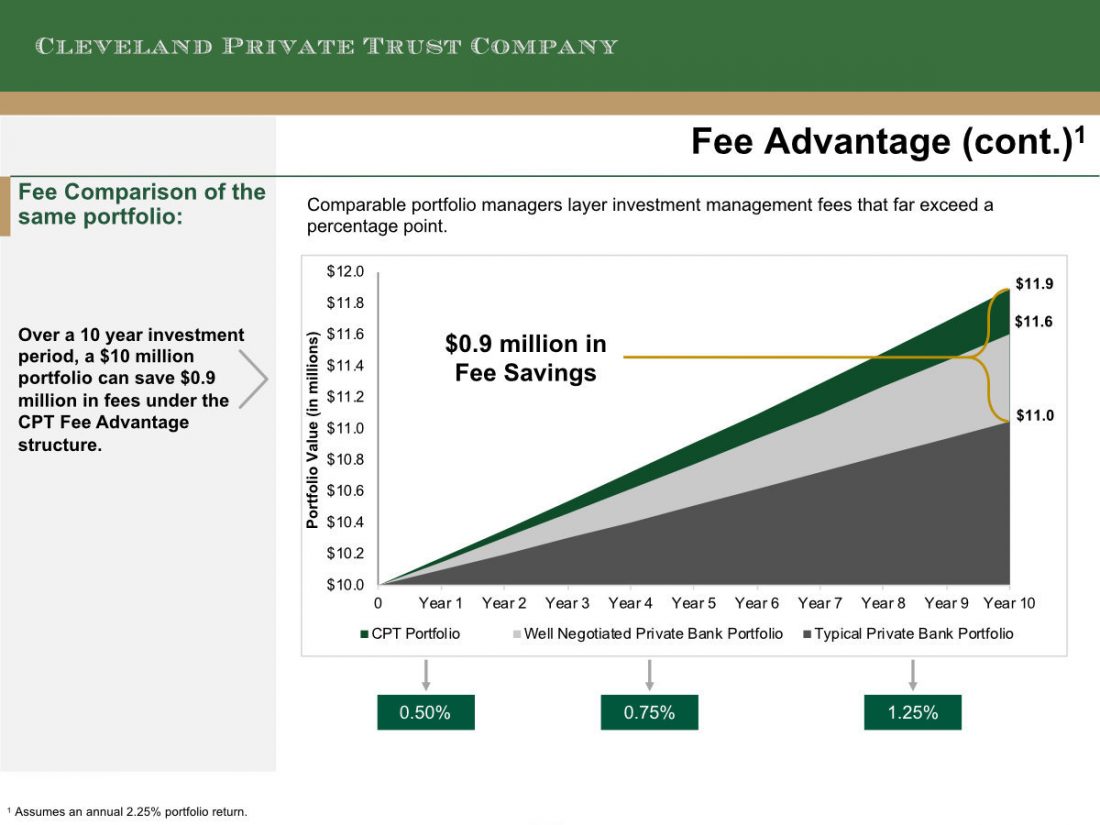

Cleveland Private Trust Company’s business model is superior to the typical Registered Investment Advisors (RIAs), broker dealers, and competing private banks. CPTCO presents a significant competitive advantage for separately managed accounts greater than $5 million. Comparable portfolio managers often layer investment management fees that far exceed a percentage point. Over a 10 year investment period, a $20 million portfolio can save $3.0 million in fees under the CPTCO Fee Advantage structure.